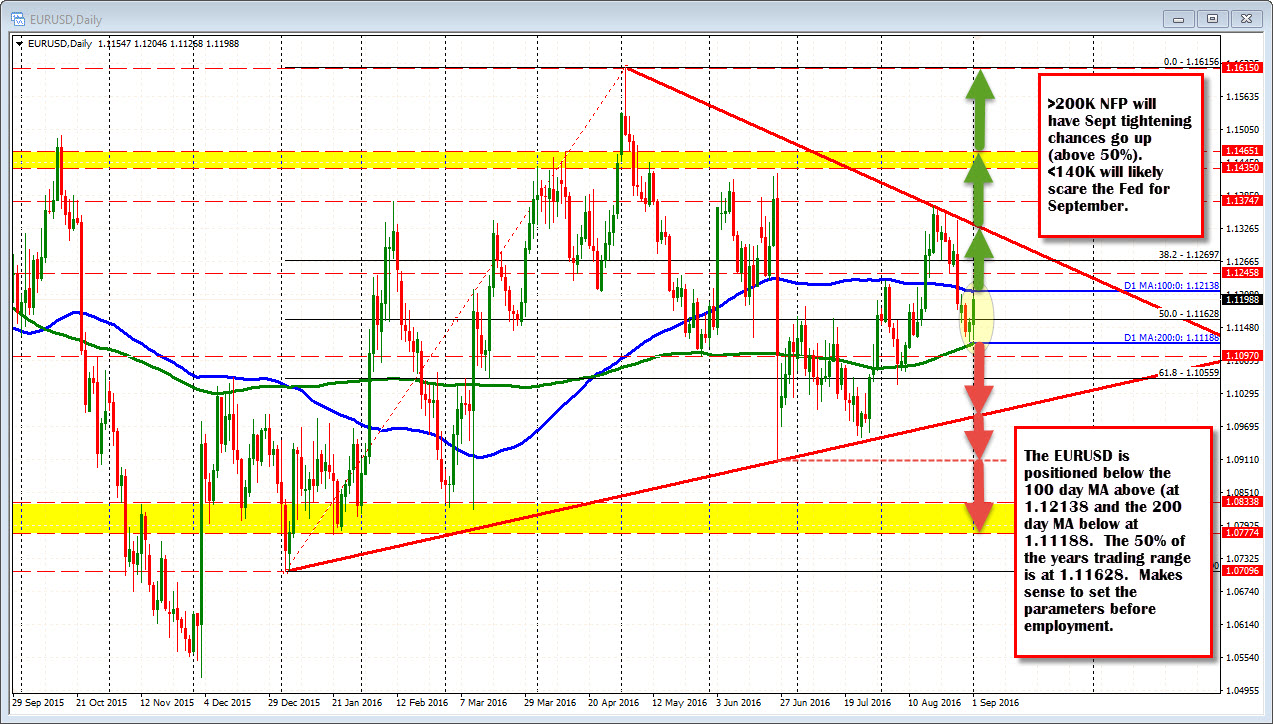

Technical analysis in exchange rates is a method which is used to predict the future trends of exchange rates in forex market by analyzing the past market data, mainly the data related to volume and price. Technical analysis in forex exchange rates forecasting focuses on recognizing the rate patterns and trends and tries to explore those trends On the forex, price action is the exchange rate variance exhibited by a currency pair. Technical analysis is used to place these movements into a manageable context by quantifying two primary characteristics: volatility and periodicity. By auditing how far and fast price has moved, tendencies in behavior often emerge 8/26/ · Technical analysis is widely used by forex, equity, and commodity traders, to determine the short term as well as the long term trends of the market. The scope of technical analysis is increasing every day, as more and more people are trying to learn the skills of technical analysis Estimated Reading Time: 3 mins

Importance Of Technical Analysis In Exchange Rates Forecasting

Technical Analysis is the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements forex be the pro techinical analysis financial instruments.

It is also the art of recognizing repetitive shapes and patterns within those price structures represented by charts. It's the study of how prices in freely traded markets behaved through the recording, usually in graphic form, of price movements in financial instruments. Because human nature behind price movements is constant, patterns repeat themselves, allowing the analyst to anticipate their future direction. Ultimately it's people that create price with their fear and greed, despite the reason for making a decision to buy or to sell.

There are three premises on which the technical approach is based :. LATEST FOREX NEWS Forex News Institutional Research. SECTIONS Latest Analysis. TOOLS Economic Calendar Interest Rates Market Hours. TOP EVENTS Coronavirus Brexit Nonfarm Payrolls Fed BoC ECB BoE BoJ RBA RBNZ SNB, forex be the pro techinical analysis. SECTIONS Bitcoin Ethereum Ripple Litecoin Bitcoin Cash Cardano Stellar VeChain Chainlink. SECTIONS Latest Live Videos Shows Schedule Become Premium.

MOST POPULAR COACHES Ed Ponsi Giuseppe Basile Sarid Harper Alex Ong Sam Seiden Steve Ruffley Rob Colville Nenad Kerkez Gonçalo Moreira Navin Prithyani David Pegler Walter Peters.

SECTIONS Forex Brokers Broker News Broker Spreads. Technical Analysis News. Technical Analysis Reports. Sponsor broker. Technical Analysis Tools ELLIOTT WAVE, forex be the pro techinical analysis.

LIVE CHART GUIDE. Positioning and Volatility. Cycle Analysis. Elliottwave Analysis. All about Technical Analysis Learn and succeed. Back inRalph Nelson Elliott discovered that price action displayed on charts, instead of behaving in a somewhat chaotic manner, had actually an intrinsic narrative attached. Elliot saw the same patterns formed in repetitive cycles. These cycles were reflecting the predominant emotions of investors and traders in upward and downward swings.

These movements were divided into what he called "waves". Some people will spend a lifetime searching for or creating a viable strategy and then not stick with it. This is the reason why when you find something that has potential you should give it enough testing as possible; in both directions, backward and forward. There are literally hundreds of technical indicators out there that a trader can use to help predict market direction.

One of them is the Ichimoku Kinko Hyo, which was developed in Japan during the previous century and which is gaining increasing popularity in the West because of its ability to identify trends.

The evolution of prices of an asset usually follows a temporal sequence. When we talk about timing, forex be the pro techinical analysis, we are not necessarily referring to each of the cycles having a period of similar length, rather we only refer to the fact that there is a relationship between a set of data for a period of time. Once this period of time is finished, the behaviour of the following data will probably show a different distribution. Forex be the pro techinical analysis are three premises on which the technical approach is based : Market action discounts everything.

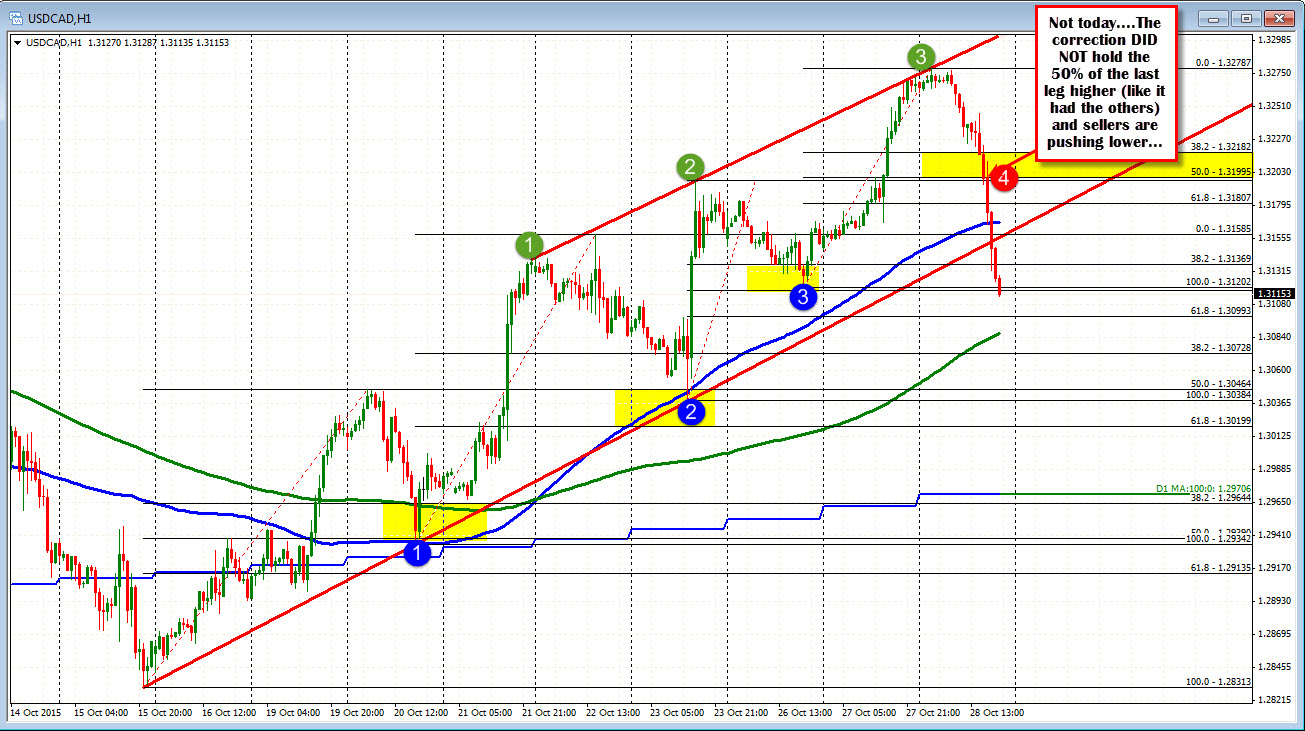

Prices move in trends History repeats itself. Support and Resistance lines conform the most basic analytical tools and are commonly used as visual markers to trace the levels where the price found a temporary barrier. In other words, where price had trouble crossing. These levels can be found on any chart and any time frame either 1 minute or 1 month.

Some of these lines remain valid for years, forex be the pro techinical analysis. When trading Moving Averages are a very good example of how to best get into a trade and how to attempt to predict what the chart will do next. We talk forex be the pro techinical analysis Darren Sinden, the Market commentator for Admiral Markets, about this subject.

As a man that has been in the stock markets for over 30 years, this is forex be the pro techinical analysis subject that Darren is very well versed on. So do not miss this video. The base system was backtested across four years of euro forex data to gather trade data for statistical analysis. As we saw, the base system was unprofitable. In mathematical terms, the base system has a negative expectancy of Let's say you took a position in the wrong direction.

This happens to everybody. You see the market approaching your stop loss, and you keep a safer distance from it, moving further away from the market and deeper into your pocket. And then you do it again and again. This usually results in a safe loss of money. More money than you planned to risk on the trade. The principle of intermarket analysis is based on the interplay between the four major asset classes: bonds, stocks, commodities, and currencies.

This article offers concrete applications for trading.

Mastering Fundamental Analysis in Forex: The Ultimate Guide! - Free Forex Course

, time: 24:38Forex Technical Analysis

Students will be able to Trade the Forex markets, be consistent and profitable. Students will have a complete understanding of the Technical aspect of the markets. Will be able to manage money the right way! Please make sure you read the Table of content of /5() 5/19/ · Basically, whenever you analyse a chart to spot patterns or see moving averages and other indicators over it, you’re using or looking at a technical analysis of the market. Technical analysis in Forex trading is used to spot key levels and figures that can give clues regarding where the price of a currency pair is headed, and it does so only using the information on blogger.comted Reading Time: 8 mins Technical analysis in exchange rates is a method which is used to predict the future trends of exchange rates in forex market by analyzing the past market data, mainly the data related to volume and price. Technical analysis in forex exchange rates forecasting focuses on recognizing the rate patterns and trends and tries to explore those trends

No comments:

Post a Comment