Mar 22, · There are quite a few differences between spot forex and commodity futures. Spot markets are cash markets - "here and now". Commodities trade via futures contracts. These contracts standardize the price, date, and delivery of an underlying "thing" or asset, such as corn, oil, T-bonds, or even single stocks The primary difference between commodity and forex trading lies in the underlying security. Commodities trades include products like coffee, cocoa, and mining goods like gold and oil. In contrast, the forex exchange market is the largest volume market for exchange, where currencies of all economies are traded in pairs The underlying difference between forex vs commodity trading is that the former deals in currencies and the latter in commodities such as oil, gold and coffee. While buying and selling of currencies depends on factors such as trade flows, tourism and geopolitical situations, commodities trade is driven by demand and supply

The difference between Forex Trading and Commodities | peeker finance

The difference between Forex trading and Commodities are mainly between the commodities which are the basis of tradable security. The demand for commodities trade in coffee, sugar, mining products, for example, in gold and oil. Forex is foreign exchange. FX is also the global market for dollars, euros and yen, which is abbreviated as the FX. Many of the methods and analyzes of both markets reflect each other. In which sector you choose, the following factors have to do with your level of comfort.

Certain markets make some people feel more comfortable. Some people like goods because they can relate to them as a physical market. Since there are many commodities in daily life, difference between forex trading and commodity trading, some traders prefer commodities because things such as sugar cane and wheat can be connected, difference between forex trading and commodity trading.

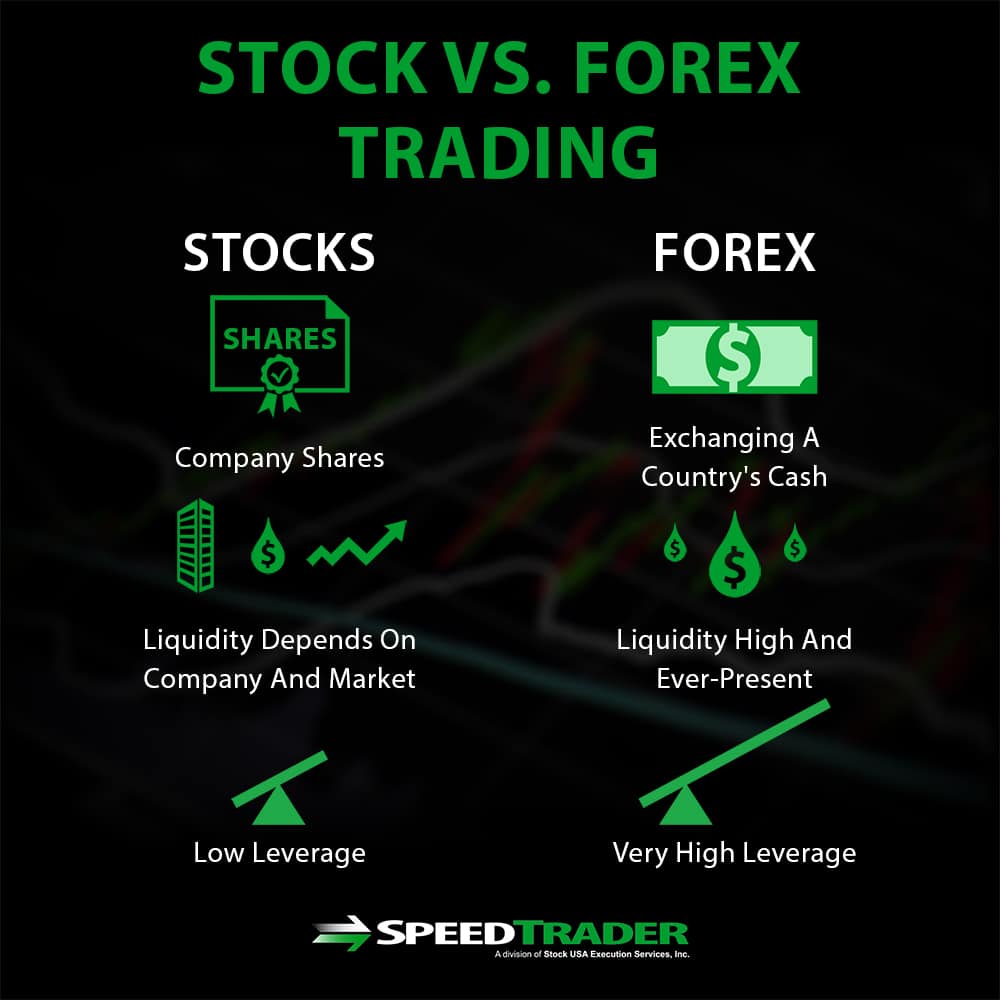

The market for goods is highly regulated, while forex is more like the wild west. There is some Forex trading account regulation, but this is much looser. The little oversight that already exists is reasonably circumvented. And some traders feel the government on their side is better off. Although in both markets there is leverage, in the trading in Forex market, there is tremendous leverage and you must not miss the hoops to get it. You can only charge a few hundred dollars and manage thousands of dollars on your account.

Although leverage in commodity markets is also an option, the leverage in foreign exchanges is far more dramatic. Commodity markets operate while foreign currencies are bought and sold by brokers or the interbank market.

Commodities trading have daily limitations when trading on an exchange. When these limits are exceeded, it is said that the difference between forex trading and commodity trading are limited or reduced and that trades can not be placed.

If one of these constraints is a products dealer on the wrong side, in fact, you are watching without the capacity to activate your account dissipate. Throughout rapid losses on the FX market, too, there are very few situations in which the escape from your trade with currency restrictions and commodity markets is absolutely impossible. A merchant who seeks a compromise might be able to trade commodity monies.

The Australian dollar, Canadian and New Zealand dollars are among these currencies. While the correlation intensity varies over time. The dairy industry of New Zealand has a similar positive relation with the prices of whole milk powder. Finally, there is a positive correlation between the Canadian dollar and the price of crude oil.

The clear trends in oil from to therefore, likewise, powerful moves have been seen by the Canadian dollar. The emerging market currencies are another aspect of the foreign exchange market.

Currencies on the emerging markets often represent commodity growth difference between forex trading and commodity trading appear to be reversed with the US dollar. Commodity currencies often pay greater turnover than market currencies created. Emerging markets currencies can thus make a good addition to the volatility in commodity trading in the right market.

Source: Reuters. Tags Commodities Commodities trading forex trading The difference between Forex trading and Commodities trading in Forex. Breaking News All you need to know about Credit card issuer The Guide for beginners about Personal Loan Origination Fees Why you need to change your bank account? The difference between Forex Trading and Commodities 28 October، forex Views. Related Articles. Next Learn More about Commodities trading.

Powered by peeker finance.

What Is Futures And Options Trading? F\u0026O Explained By CA Rachana Ranade

, time: 11:50Trading forex vs stocks vs indices. Which one is better? - Living From Trading

Jun 17, · The fundamental difference between forex and commodity trading has to do with the underlying security. Commodities trade involves goods like cocoa, coffee, and products that can be mined like oil and gold. On the other hand, forex —or foreign exchange — is a global market that trades in currencies like rupees, euros, dollars, and blogger.comted Reading Time: 4 mins Oct 28, · The difference between Forex trading and Commodities are mainly between the commodities which are the basis of tradable security. The difference between Forex Trading and Commodities The demand for commodities trade in coffee, sugar, mining products, for example, in gold and oil. Forex is foreign blogger.comted Reading Time: 2 mins Dec 11, · That makes them great to day trade or scalp. Forex is what has the lowest volatility, so it’s the worse one to trade, especially short-term. Indices are in the middle, between forex and stocks. They are an excellent option for day trading. Keep in mind that you need volatility to trade. It creates steady long trends with clear entry blogger.coms: 2

No comments:

Post a Comment