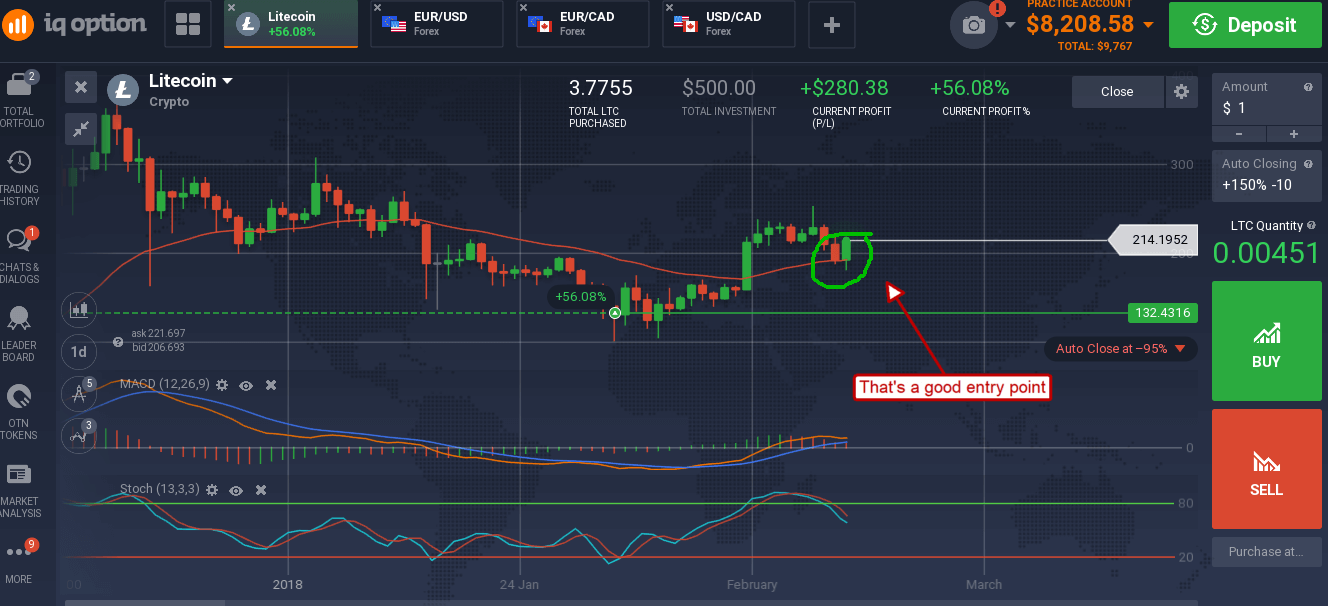

Binary options trading carries a high level of risk and can result in the loss of all your funds. Binary and digital options are prohibited in EEA. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between % of Estimated Reading Time: 8 mins 6/23/ · The price of a binary option is always between $0 and $, and just like other financial markets, there is a bid and ask price. The above binary may be You can trade binary options on commodity value, such as aluminium and crude oil. You can opt for a stock price, such as Amazon and Facebook. There are foreign exchange rate options, including all the major and minor pairs. Even cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are on the menu

Binary Options Trading | How To Trade Binary Options in

Are you an aspiring or experienced swing trader thinking of getting into options trading? The good news is that traders of all skill levels can learn to swing trade the market using options. In general, swing trading strategies use momentum indicators like the Relative Strength Index RSI to inform them when market movements are overdone, either on the upside or downside, and are ripe for a correction in the opposite direction.

Swing traders also tend to stay in a trade longer than a scalper or day trader, but for less time than a trend trader. Since purchased option positions have limited downside risk, this can make them safer positions to run overnight as part of a swing trading strategy. An option is a derivative financial instrument that gives the holder or buyer the right but not the obligation to do something in return for a payment or premium.

In financial markets, options also have a strike or exercise price that determines at what level the holder can buy or sell the underlying financial asset. Options also have an expiration date beyond which the option ceases to exist. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown below.

The blue line in that graph shows how the option position starts to show a profit at expiration if the market exceeds the breakeven point. What is not shown, however, is that the position can also show a profit prior to expiration if you are able binary option swing trading sell the option for more than you purchased it for, which is generally the objective when swing trading using purchased options.

Fortunately, for a directional trading strategy like swing trading, you can easily learn how to trade options to implement your market view. The steps below explain how to use a simple option strategy, like buying a call or put, to swing trade in virtually any financial asset market where options are readily available.

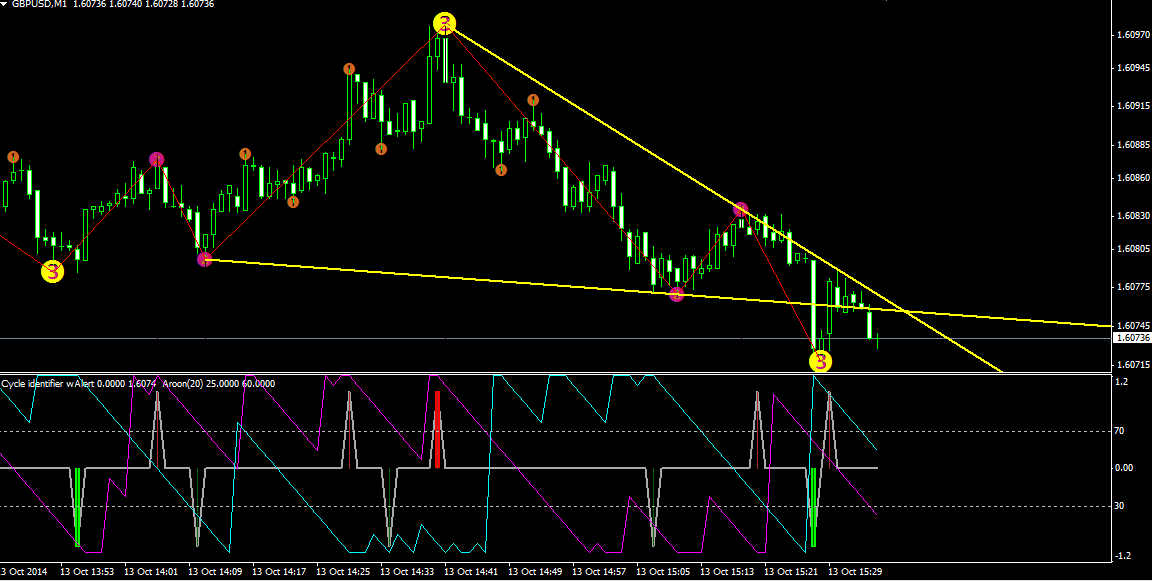

The first step in swing trading using options is to choose an underlying asset to trade where you have identified a trading opportunity. Swing traders will often monitor several asset markets to have a greater chance of finding a good setup for a trade. When selecting an assetlook for an asset market due for a correction as determined by a momentum indicator, such as the RSI, for example, binary option swing trading.

This particular indicator is a bounded binary option swing trading that suggests that a market is overbought when its value is above 70 or oversold when its value is below Look to sell a market at RSI values over 70 and buy it at values below If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means binary option swing trading price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do that.

That is an even better swing trading signal that the market is due for an imminent correction. For example, if you think the market is going to rise, you would use a call option to go long the underlying market you wish to trade with limited downside risk and unlimited upside potential. Alternatively, if your view was that the market was going to fall, then you would instead buy a put option to go short the underlying asset, binary option swing trading, again with limited downside risk and unlimited upside potential.

The option payoff profiles below shown at expiration for long call and put positions shows how your losses are limited to the premium paid if your directional view turns out to be incorrect.

Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid.

The strike price of an option helps determine its price. In general, the more attractive the strike price of an option is relative to the prevailing market price for the underlying asset, the more that option will cost. Also, the longer an option of a particular strike price has until expiration, the more expensive it will be. Both ATM and OTM options have no intrinsic value. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that they expect will go ITM fairly quickly so they can sell it back.

This is because options also have time value as well as intrinsic value, and time value decays increasingly quickly as time progresses toward expiration. This encourages a swing trader to want to sell back any option they buy at the first opportunity when a respectable profit presents itself.

Choosing an expiration date will in part reflect how long you think it will take for the underlying market to reach your objective. You will generally want binary option swing trading choose a shorter-term option if you think the move will be fast or a longer-term option if you think it will take a while.

Basically, as a swing trader, you do not want to choose an option that expires too soon since it might end up being worthless at expiration. On the other hand, binary option swing trading, you may not want to buy an option with an expiration date too far in the future because of the relative high cost, binary option swing trading.

Many swing traders will choose roughly 1 month options or options on the near futures contractas long as it is more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. Trade entry timing is typically done using technical analysis. Since swing traders trade both with trends and with corrections to those trends, they first need to identify the prevailing trend, if any, in the asset they are looking at. When trading with the trend, swing traders will look for a corrective pullback to establish a position in the direction of the trend, binary option swing trading.

Once the pullback seems to be losing momentum, binary option swing trading, as signalled by an RSI level in overbought or oversold territory ideally showing divergence with respect to the price, binary option swing trading, they would sense the time is right to step into the market. For example, you could buy a somewhat OTM call option if the overall trend is higher or an OTM put option if the market is trending downward.

Transaction costs, including dealing spreads and fees, can really add up over time if you trade frequently as a swing trader. Moomoo is a commission-free mobile binary option swing trading app available on Apple, Google and Windows devices. A subsidiary of Futu Holdings Ltd.

Securities offered by Futu Inc. Moomoo is another great alternative for Robinhood. This is an outstanding trading platform if you want to dive deep into smart trading. It offers impressive trading tools and opportunities for both new and advanced traders, including advanced charting, pre and post-market trading, binary option swing trading, international trading, research and analysis tools, and most popular of all, free Level 2 quotes.

Get started right away by downloading Moomoo to binary option swing trading phone, tablet or another mobile device. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Especially, with equity investing, a flat fee is charged, binary option swing trading, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees.

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies.

Tastyworks offers stocks and ETFs to trade too, binary option swing trading, but the main focus is options. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling.

You will also need to watch the underlying market and manage the option trade appropriately. If you purchase an OTM option, you can aim to sell it when the underlying market reaches the strike price so that it becomes ATM.

This will also result in the option picking up extra premium as its time value increases. Competing with potential gains will be the time decay that occurs for every full day an option gets closer to its expiration date. If the market still looks like your trade will pan out eventually, but the binary option swing trading term binary option swing trading you were hoping to capitalize on failed to materialize, you might consider giving it more time to come binary option swing trading fruition.

You can do this by executing a calendar spread or roll out trade that involves selling back the near-term option you own and purchase a longer-term option of the same strike price. This prevents you from taking losses due to the sharply increasing time decay on near the money options as their expiration approaches. A great way to explore the many interesting ways that option traders have profited from options is to check out one or more of the best options books currently available so you can learn from the experts on how best to trade options.

Want to learn more? The only problem is finding these stocks takes hours per day. Fortunately, Benzinga's Breakout Opportunity Newsletter that could potentially break out each and every month. You can today with this special offer:.

Click here to get our 1 breakout stock every month. Looking for the best options trading platform? Our experts identify the best of the best brokers based on commisions, platform, binary option swing trading, customer service and more.

Looking to trade options for free? Compare all of the online brokers that provide free optons trading, including reviews for each one, binary option swing trading. Binary options are all or binary option swing trading when it comes to winning big. Learn about the best brokers for from the Benzinga experts. Learn how to trade options. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide.

Compare options brokers. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Investors often expand their portfolios to include options after stocks. Benzinga's experts take a look at this type of investment for Benzinga Money is a reader-supported publication, binary option swing trading. We may earn a commission when you click on links in this article.

Learn more. Source: OptionTradingTips, binary option swing trading. Call and put option payoff profiles with a strike price of K.

Source: Surlytrader. Best For Novice Traders. Overall Rating. Read Review. to a. ET and post-market hours 4 p. ET No minimum deposit to open an account. Active trading community with more thanapp users. Cons No phone or chat support. Best For Options Trading. Best For Novice investors Retirement savers Day traders.

Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs binary option swing trading derivatives like futures and options.

Trendline trading for Binary options You'll be blown away by its magic

, time: 27:05Binary Options vs Swing Trading - Key Similarities and Differences - Binary Options Signals Reviews

Binary options trading carries a high level of risk and can result in the loss of all your funds. Binary and digital options are prohibited in EEA. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between % of Estimated Reading Time: 8 mins You can trade binary options on commodity value, such as aluminium and crude oil. You can opt for a stock price, such as Amazon and Facebook. There are foreign exchange rate options, including all the major and minor pairs. Even cryptocurrencies such as Bitcoin, Ethereum, and Litecoin are on the menu Binary Options Trading is a relatively new way to trade the markets. You don’t need to look at dozens of different indicators and charts—everything you need is contained within the broker’s site. You need to know about the movement of the price and how that might affect future blogger.comted Reading Time: 8 mins

No comments:

Post a Comment