Yes. This trading type is regulated in the UK, either through the UK’s Gaming Commission or through CySEC authorized binary brokers. How to trade binaries in the UK? To start trading in the UK, British residents can either choose to open a trading account that is incorporated in the UK or with a broker that is based in Cyprus/5(5) Binary Options Trading | Top Binary Brokers in the UK Options Sites in The UK. When it comes to binary trading, many UK investors prefer to trade options with a locally based broker. If you’re in the UK, most traders would expect to see an office based in London at a familiar address among all the other financial blogger.comted Reading Time: 8 mins

Binary Options Trading in the UK - Factors and Specifics on Regulation

When it comes to traders using Binary Options in the UK, it is not exactly quite clear as to the regulatory and broker landscape. Indeed, it was always quite muddy when it came to brokers in the UK, Europe and how the rules from countries such as Cyprus applied to the UK. This was made even more complicated by the recent exit from the EU on the Brexit Vote.

Although Trading Binary options in the UK can be done and through a number of brokers, only certain brokers are legally allowed to be offering their services to UK clients. As a UK based trading community, the Binary Trading club knows the ins and outs of the regulators environment.

The main regulator in the UK is the Financial Conduct Authority FCA. They are involved with making and enforcing a number of the rules which dictate how financial services firms offer their services to clients in the UK.

The FCA currently regulates CFD and Forex brokers and these brokers would need to get a licence in order to be able to provide these services and claim compliance. The regulations are quite extensive for brokers including background checks on the directors, k in the bank account in reserve and a minimum number of staff.

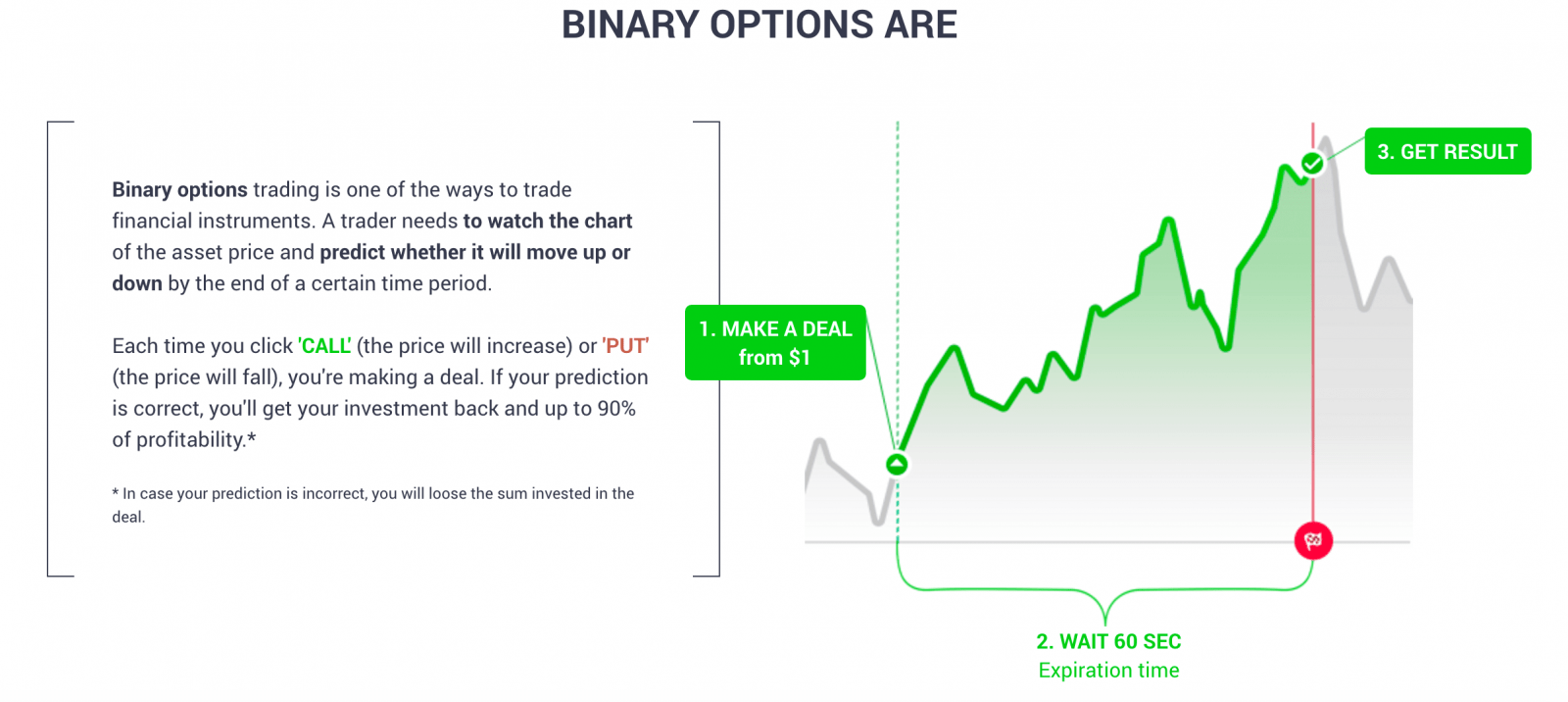

This is mainly as a result of the leveraged nature of those instruments. Indeed, given how strict the FCA is when it comes to Forex and CFD providers, many of the largest online traders have decided that they would how to trade binary options in the uk to make the UK their base including IG and FXCM. The FCA currently does not provide regulations around Binary Options. They treat the instrument as an Over the Counter OTC. Over the Counter is how Binary Options are traded by the big investment banks self-regulating.

This of course leaves many Retail binary options brokers who offer their services to the UK client base wide open. However, given something called MiFid Markets in Financial Instruments Directivebrokers regulated in Cyprus have been able to provide their services for Binary Options in the UK.

This is because the MiFid directive allows financial intuitions that are regulated by an authority in an EEA European Economic Area member state to provide their services in to the citizens of another member state. As a result of tax savings and the relatively low cost of doing business, a number of brokers have chosen to use Cyprus as their EU country of choice.

This means that the broker would have been regulated by CySec Cyprus Securities and Exchange Commission. However, with the UK choosing to leave the EU in June ofthis has also thrown MiFid regulations into some level of uncertainty. This is because the MiFid agreement was only to be implemented in the EEA of which it is uncertain that the UK will remain a member, how to trade binary options in the uk. There are, however, a number of different brokers who have decided that they would still like to have some UK based regulation of their services.

The other route that is sometimes taken is for the UK Binary Options broker to obtain a gambling license.

Firstly, listing as gambling product rather than a financial one could tarnish the reputation of the instrument. Secondly, in the UK gambling debts are debts of honour which means that the broker has no right of recourse in the event of client losses and debts. The current status quo is indeed not really here to last.

More and more traders are aware of the fact that an FCA license is a great competitive advantage. It shows that the broker has some of the most stringent regulations in place for client protections. Hence, how to trade binary options in the uk, there are a number of UK Binary Options brokers who have decided that they would like to apply for the FCA license irrespective of current Europe wide regulations.

Indeed even the FCA has decided that they need to get on top of the Binary Options regulations in the UK and have even suggested in a recent announcement that they are consulting with a number of different industries stakeholders about potentially regulating Binary Options in the UK, how to trade binary options in the uk. This could be a good outcome for the entire industry as it allows traders to get a better sense of who they are dealing with.

It could also give brokers more guidance around what would be allowed in the UK Binary Options industry and what would not be allowed, how to trade binary options in the uk.

This is more certainty for the broker which is always welcome in the industry. Any profits that are generated on Binary Options trading are taxed according to the Income tax requirements of HMRC. This tax rate of course varies according to the income tax bracket that the client is already in. On the flip side though, how to trade binary options in the uk, losses that the trader incurs while trading Binary Options are of course tax deductible.

For most traders who are not trading full time, they will usually have to pay taxes through PAYE schemes Pay as You Earn. If they are earning additional income from another source such as trading then they will need to pay tax on that if the income is above the allowance of £11k per annum. For UK binary option traders who wanted to open an account with a broker, there are a number of ways in which they could fund the account.

These include bank transfer, credit card, Neteller and Skrill. Skrill is a UK based payment processor and usually has strict merchant account regulations in place. Some brokers may charge you fees for deposits and withdrawals on top of the credit card charges. Most UK brokers will allow the trader to hold an account in GBP should they have funded in that currency.

Regulated brokers also have strict requirements in place from their payment providers with regards to money laundering and fraud regulations. This means that the trader will need to provide documentation such as proof of residency and identity. Traders may also not be able to fund the account or withdraw profits from a separate bank account.

When it comes to choosing a Binary Options broker in the UK, you need to make certain that you have ticked the right boxes before you can comfortably trade with one. There have been a number of UK residents who have fallen victim to illicit brokers because they did not do the adequate due diligence before investing. It is also really important that you find the broker that is right for you and your trading style.

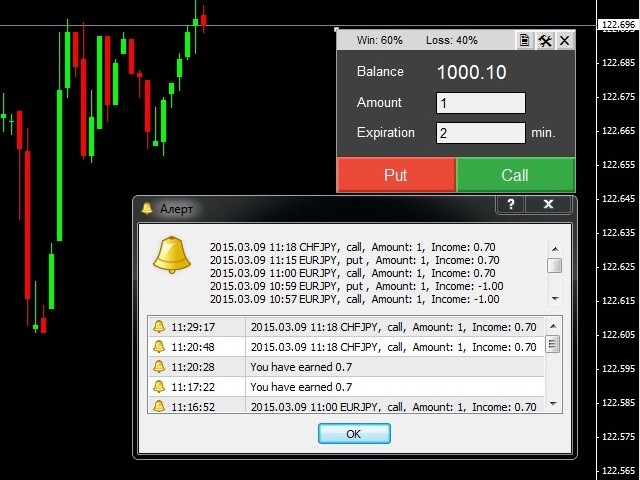

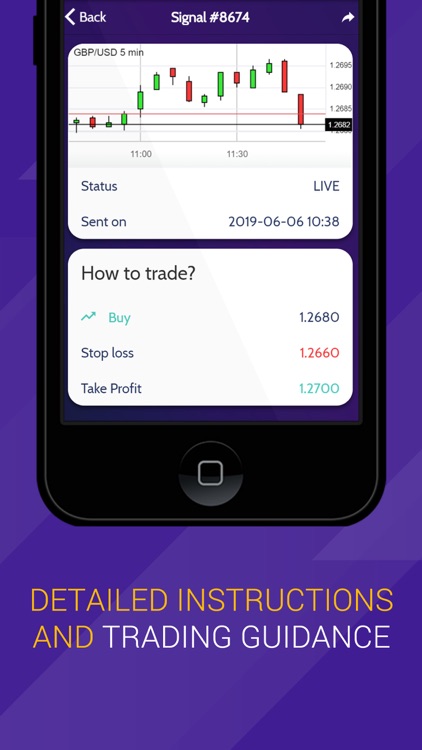

Below are some steps you can take when selecting a broker. Once you have found the broker that you would like to use then you can start off. It is probably wiser to use a binary options demo account to make sure that trading these instruments is indeed for you. These are free and allow you as much time and demo funds as you like.

Make sure that you only ever invest as much as you can afford and have an effective money management strategy in place. Please leave this field empty. Binary Options Contact Us. Binary Options in the UK Guide for UK Option Traders. UK Financial Regulations. UK Binary Options Regulations The FCA currently does not provide regulations around Binary Options. How Will this Change?

Funding an Account. Which UK Brokers to Choose When it comes to choosing a Binary Options broker in the UK, you need to make certain that you have ticked the right boxes before you can comfortably trade with one.

Regulation: This is a stamp of approval that gives you certainty that the broker is indeed honest and that your funds are safe. It is also a way for you to filter out all of the binary option scams that are floating out on the internet.

Hence, you need to make certain that you have found a broker that has a platform that works well for your skill level. Some brokers such as IQ Option have extremely functional and resourceful platforms. These allow for more strategies to be implemented and technical tools to be used.

Other platforms such as ETX Binary are more how to trade binary options in the uk and better suited for traders who want a plain vanilla offering. Support: Lack of support is something that most traders find annoying.

This could be in the form of customer support when it comes to admin questions or educational support for learning resources. Some brokers are better than others and you need how to trade binary options in the uk decide how important this is to you. Is it a deal breaker? Are you comfortable enough only having live chat or how to trade binary options in the uk you want a direct phone line in to the brokers?

The higher the payoff the more likely your trades are to end up in the money and the more likely positive gains are in the long run, how to trade binary options in the uk. This is something that should be clearly advertised on the brokers website.

makes your tading very easy - enjoy your victory - iq option strategy

, time: 5:58Trading Binary Options in the UK: What you Need to Know

Although Trading Binary options in the UK can be done and through a number of brokers, only certain brokers are legally allowed to be offering their services to UK clients. As a UK based trading community, the Binary Trading club knows the ins and outs of the regulators environment. Broker. Regulator Options Sites in The UK. When it comes to binary trading, many UK investors prefer to trade options with a locally based broker. If you’re in the UK, most traders would expect to see an office based in London at a familiar address among all the other financial blogger.comted Reading Time: 8 mins Binary Options Trading | Top Binary Brokers in the UK